Everyone talks about the glittering start-up scene – glamour, success, wealth.

The reality? Mostly blood, sweat and tears. Less than 5 % of start-ups actually make it.

What seems harsh or unfair at first glance follows the logic of a capitalist system: Survival of the fittest.

The start-up world is a tough selection process – not only of ideas, but above all of good or bad management. VCs are the vehicle for catalysing this process.

VCs are investment vehicles for high-risk bets: high return expectation

🔺 high risk = 💰 high return expectation

A typical VC portfolio of 20 start-ups:

~50% fail in the first few years

~40% survive but stagnate (‘living deads’)

1-2 deliver the ‘factor-XX(X)’ and the big return

VCs are often merciless, but predictable – and a good mirror for every start-up:

✅ Strong signal if they invest:

The team, the idea and scalability are convincing.

⚡ If they decline, you should reflect honestly:

Is it the team? The business model? Or does it simply fit better as an SME?

Poor performance, deviations from the plan, bridge funding- all of this is penalised – just like in the ‘normal’ economy – only much faster.

Sure, everyone in the scene is “#buddy”, everything is hip, everything is nice. But the truth is:

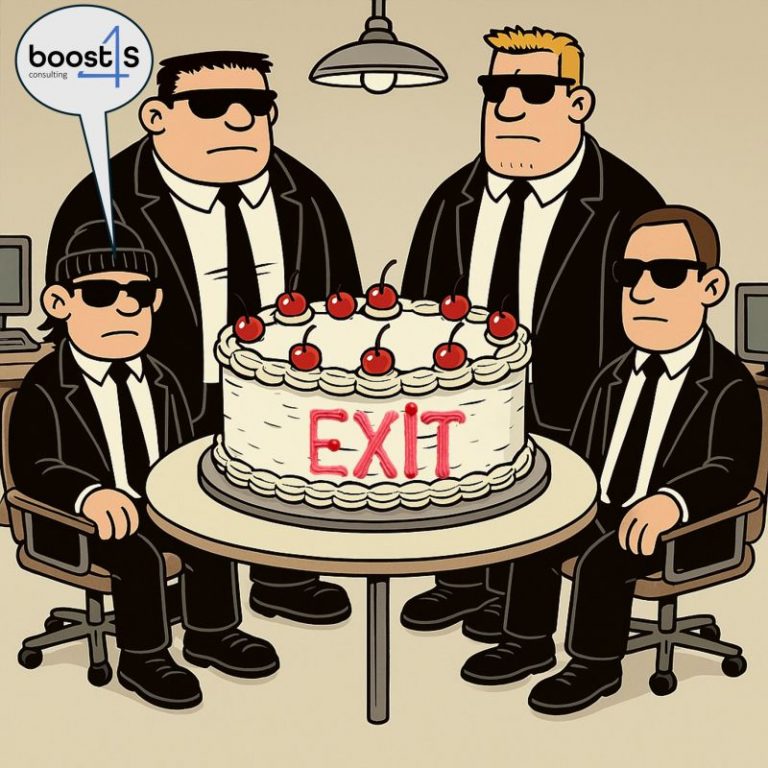

The VC world is not a pony farm but a super-tough yield machine.

👉 VCs are neither Jedi Knights nor part of the dark side – they are the catalyst for ideas, founding teams and markets.