Background of the German tech start-up:

Young start-up that spent the last 12 months building an incredibly cool MVP to maximise the usability of their tech / solution for their customers. Now it should go to the market as well as into fundraising.

Key learnings:

1) Market: a thorough market analysis showed that for a VC-focused start-up, the market volume and growth potential was limited

2) Competition: Many regional players with technically weaker solutions on the market; however, large international players with large R&D budgets in at least 2 neighbouring markets

3) Sales cycle: time from lead to conclusion longer than expected for rather high-priced B2B solutions (12+ months)

Results:

We were able to show a strategic path on how the founders (100% ownership) can build an attractive and profitable business. The start-up has great potential as an SME, but less so as a VC-backed company.

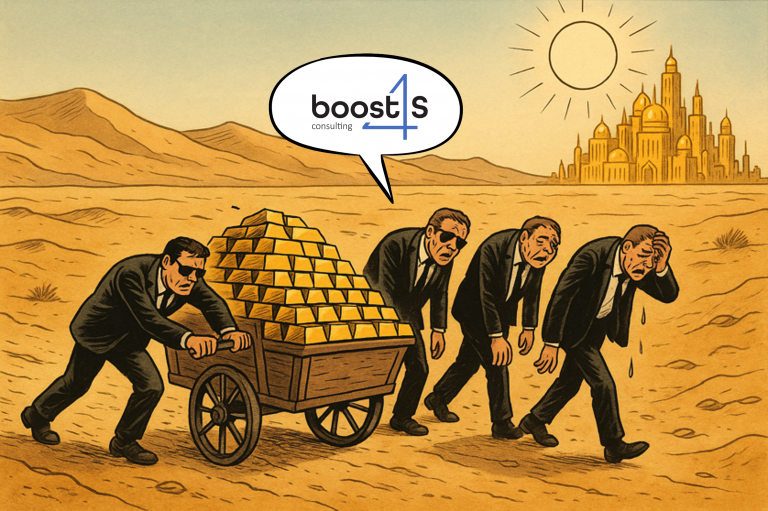

Conclusion: Scaling = difference between an artist and a factory

Scaling is an essential factor for a successful fundraising from VCs and business angels. Without sufficient scaling and valuation potential, the classic route is the better one, albeit perhaps not quite as spectacular.